I reviewed the below FactCheck for the conversation. Unfortunately there is little space as a reviewer to say much but I would like to have gone into more detail discussing who really loses and who benefits from changes in company tax rates.

I’ve advocated in the past for a reduction in company tax rates but only as part of reforms that increase taxes on speculation and rent-seeking. I don’t think the overall tax burden should be reduced but I do think we could target it better so that we encourage productive economic activity that doesn’t damage the environment while discouraging speculation and other rent-seeking.

FactCheck: is Australia’s corporate tax rate not competitive with the rest of the region?

It is true that our “headline” (or statutory) corporate tax rate of 30% is higher than that of many other countries. (AAP Image/Dean Lewins)

By Kevin Davis, Australian Centre for Financial Studies

“Well, Jon, the Government’s about to bring in a 1.5% corporate, or company, tax cut from the 1st of July. That’s something that obviously we support, because (the) corporate tax rate at 30% is not competitive with the rest of the region and we need to drive that down.” – Innes Willox, Australian Industry Group Chief Executive, ABC Melbourne Radio with Jon Faine, February 3, 2015.

Mr Willox’s comment followed Prime Minister Tony Abbott’s National Press Club speech on February 2, where he promised “a small business company tax cut on July 1 – at least as big as the 1.5% already flagged.”

It is true that Australia’s “headline” (or statutory) corporate tax rate of 30% is higher than that of many other countries, particularly some like Hong Kong, Singapore and Ireland, which have used low tax rates to help attract international investment.

When asked by The Conversation for data to support Mr Willox’s statement, a spokesman for the Australian Industry Group referred to the Henry Tax Review, which found that:

“Relative to other similar size OECD countries, Australia’s company income tax rate is high.”

As the table below shows, Australia’s rate is above typical Asian and European rates in 2014, but not markedly out of line with the G7 countries (Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States).

[The original article contains a figure comparing headline company tax rates but I could not reproduce it here for some reason.]

Apples and oranges

But, Australia’s dividend imputation tax system means that any comparison of our current 30% rate with statutory corporate tax rates elsewhere is like comparing apples and oranges.

Much of Australian company tax paid is rebated to shareholders, via the distribution of franked dividends and the attached tax credits are used by Australian shareholders to offset their income tax. The more tax paid by the company, the less to be paid by the investor.

Imputation tax systems are rare internationally, with Australia and New Zealand the main examples. In contrast, there is generally “double taxation” of dividends (full investor-level taxation of dividends paid out of after-tax company income) in classical tax systems common overseas, although some involve a lower personal tax rate on dividends versus wage income.

To illustrate the difference, let’s say we had $100 of Australian company income. Australian company tax is paid at 30% and the remaining $70 is paid to an Australian shareholder with tax imputations attached to them. For argument’s sake, let’s say that shareholder is also on a 30% income tax rate. That $70 of dividend income they just received would not be taxed again. The total government tax take is $30. For the same situation under a classical tax system, the investor would be levied a further $21 of income tax (30% of the shareholder’s $70 dividend), giving a total government tax take of $51.

So, in the case where the Australian company has only Australian shareholders to whom it distributes all after-tax income as franked dividends, the company tax is “washed out” via the tax credits distributed to the shareholders.

Reducing the company tax rate would simply mean the company in the example above distributes more cash but fewer franking credits to attach to the dividend. Less tax would be paid by Australian companies and more by Australian shareholders in the form of income tax.

If company tax rates were lowered, foreign companies would pay less tax and the shortfall in the government tax take would not be made up by income tax (because foreign firms cannot distribute franked dividends to shareholders).

Overall government tax revenue may decline because of less company tax paid by foreign companies and also where Australian companies retain earnings rather than paying them all out with franking credits attached.

Foreign investors want less company tax

Franking credits are of no value to foreign investors who would benefit if the company tax rate were lower. So foreign investors do look closely at how Australia’s corporate tax rate compares with other countries.

But foreign investors also consider non-tax issues, including government budgetary outcomes, when deciding where to invest.

Verdict

It is true the corporate tax rate at 30% is higher than some other countries in our region, but it is average compared to G7 countries. Further, Australia’s franked dividends system means Australian shareholders already enjoy favourable tax conditions on income earned from their investment in companies. However, foreign investors do not benefit from franked dividends and would benefit from a lower company tax rate in Australia.

Review

I agree with all of what has been said above but would add that Mr Willox’s statement conceals some value judgements.

As Kevin Davis has shown above, it is true our headline corporate tax rate of 30% is higher than that of our neighbours in the region. But given our system of dividend imputation, it is questionable at best to say that having a headline corporate tax rate higher than our neighbours makes us uncompetitive. Economic and political stability are big factors for businesses making investment decisions, as is available infrastructure, wage rates, other taxes, and the nature of the industry in question.

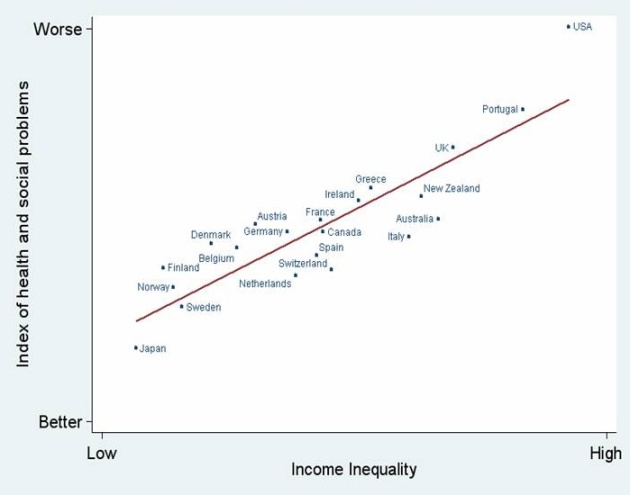

To Kevin’s analysis, I would also add that there is potential for a “race to the bottom”, where international competition drives company tax rates ever lower, resulting in ever dwindling government services for the population. – Warwick Smith

This article was originally published on The Conversation.

Read the original article.